Blockchain & DeFi

Citi’s U‑Turn: From Skeptic to Backer in the Stablecoin Race

- Share

- Tweet /data/web/virtuals/383272/virtual/www/domains/theunhashed.com/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 63

https://theunhashed.com/wp-content/uploads/2025/10/citi-1000x600.png&description=Citi’s U‑Turn: From Skeptic to Backer in the Stablecoin Race', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

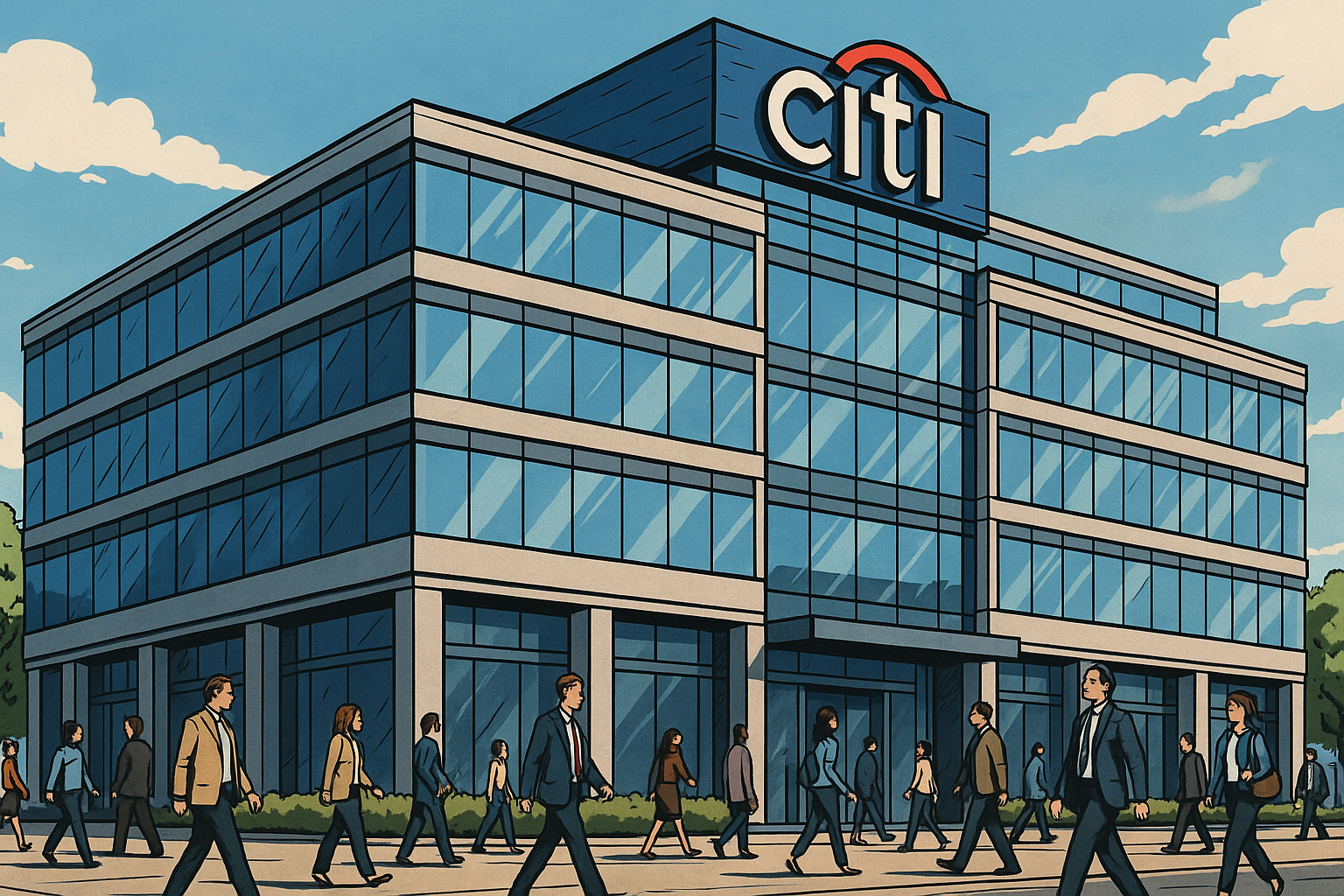

In a surprise twist for observers of institutional crypto adoption, Citigroup has decided to invest in stablecoin infrastructure firm BVNK—a move that marks a sharp pivot from its earlier stance warning of deposit flight risks linked to yield‑bearing stablecoins. According to reports, the investment is being funneled via Citi Ventures, with BVNK’s valuation now believed to exceed $750 million. The exact size of Citi’s stake remains undisclosed.

From Caution to Commitment

Only months ago, Citigroup had publicly flagged stablecoins as a potential threat to the traditional banking model. One of its analysts warned that high-yield stablecoin products could provoke a mass exodus of deposits—especially from smaller community banks—which, in turn, might destabilize banks dependent on regulated deposit inflows.

But the tides have changed. BVNK, already backed by heavyweights including Coinbase and Tiger Global, has been quietly building a payments-rail model that bridges fiat and stablecoin flows. With U.S. regulatory clarity improved by recent legislation (notably the GENIUS Act), the environment for stablecoin infrastructure now looks more hospitable. BVNK’s cofounders say U.S. markets have been its fastest growth frontier over the past 12 to 18 months.

For Citigroup, the timing also aligns with its own strategic recalibration. Earlier in the year, the bank floated the possibility of issuing its own stablecoin and expanding custodial services for digital assets. The investment in BVNK may help Citi stay at the cutting edge of that shift.

Bridging Trust and Innovation

BVNK’s model is essentially that of a payments infrastructure provider: it facilitates cross-border transactional rails using stablecoins, enabling faster and more efficient movement of value compared to traditional banking routes. By placing capital behind BVNK, Citi is effectively saying it wants “in” on the plumbing that undergirds a future of digital-first money movement.

This isn’t just about enabling crypto firms. It’s also about positioning legacy finance to ride the transition toward tokenized value. With BVNK serving as a node between fiat and stablecoins, Citi can lean into the utility of blockchain rails without necessarily becoming a pure-play crypto firm itself.

Navigating Friction and Risk

Still, the move comes with inherent tension. Citi’s prior warnings weren’t baseless: stablecoins offering competitive yields could entice depositors away from traditional banks, particularly in light of banking regulations that cap deposit interest rates. Some industry groups even lobbied Congress to limit yield‑bearing stablecoin activities, citing catastrophic outflows as a theoretical risk.

However, proponents argue that stablecoins represent a competitive force that prompts legacy institutions to modernize rather than retreat. Critics of strict regulation say stifling yield-bearing stablecoins would favor entrenched incumbents at the expense of innovation and consumer choice. BVNK’s rise (with Citi’s backing) may be a test of that tension.

What This Means for the Stablecoin Ecosystem

Citi adding its weight behind BVNK signals several shifts in the crypto–finance dynamic:

Institutional legitimacy. Large banks stepping into stablecoin infrastructure lend credibility to the notion that tokenized money is not a fringe play, but part of the next-generation financial stack.

Alignment of incentives. Rather than treating stablecoins as antagonistic, this move frames them as infrastructure partners. Citigroup is formally aligning with the rails rather than opposing them.

Competitive pressure on legacy banks. If Citi and others begin treating stablecoins as core infrastructure, banks that maintain strict resistance may find themselves displaced in payments markets.

Regulatory test bed. As Citi engages publicly, the firm may be one of the first large institutions to stress-test how compliance, risk, and governance meet with stablecoin operations under mature regulatory regimes.

For BVNK, the investment represents both a vote of confidence and a new set of expectations—operational rigor, compliance maturity, and scale. For Citi, the bet is on being a bridge that survives and thrives in the tokenized-age evolution of banking.

In the coming months, market watchers will be watching every move: how BVNK deploys its capital, how regulators respond to this bold institutional stake, and whether other banks decide to follow—or push back. At a minimum, Citi’s shift makes clear one thing: stablecoins aren’t just a crypto curiosity anymore. They’re infrastructure, and large finance is starting to treat them that way.

Blockchain & DeFi

Exodus Goes Full Stack: Wallet Giant Acquires W3C to Dominate Crypto Payments

In a major leap toward integrating self-custody wallets with everyday finance, Exodus Movement has signed a $175 million deal to acquire W3C Corp, the parent company of crypto-friendly payment providers Baanx and Monavate. The acquisition puts Exodus squarely on the path to becoming a vertically integrated player in the crypto payments ecosystem—controlling everything from asset storage to transaction rails.

Wallet meets payments infrastructure

Exodus has built its brand on providing sleek, user-friendly wallets that give users full custody of their digital assets. But this move signals a new ambition: to turn those wallets into true financial hubs, enabling users not only to hold crypto but to spend it with the same ease as fiat currency.

With Baanx and Monavate now under its umbrella, Exodus gains direct access to critical infrastructure like card issuing, transaction processing, and compliance frameworks. That means Exodus users could soon swipe a debit card backed directly by their on-chain assets, or access stablecoin payments seamlessly integrated into the app.

This isn’t about being another crypto wallet. It’s about being the first wallet that also functions like a bank.

Terms of the deal and financing

The acquisition, expected to close in early 2026, is financed through a mix of cash and credit. Exodus is securing funding via a lending facility with Galaxy Digital, backed in part by its Bitcoin holdings. This is both a savvy move and a calculated risk—using crypto collateral in a volatile market can amplify upside, but also exposes the company to market drawdowns.

Still, the message is clear: Exodus is betting on Bitcoin long term, and is leveraging its own balance sheet to double down on crypto-native financial infrastructure.

Strategic shift: from holding to spending

What makes this deal so significant is the directional shift it signals. Most wallets—hardware or software—have stopped short of solving the everyday usability problem. People can hold assets, but spending them usually requires off-ramping through exchanges, third-party cards, or custodians.

By contrast, Exodus now controls a vertically integrated stack that could take a user from cold storage to tap-to-pay in seconds. If executed well, it could mark a major evolution in self-custody—from a niche security practice to a full-featured alternative to traditional banking.

It also opens the door to stablecoin integration, programmable payments, and more advanced DeFi access—all without compromising user control of private keys.

Risk profile: market exposure and compliance

Of course, there are headwinds. The integration of payments infrastructure is complex, especially in jurisdictions where financial compliance is stringent and ever-changing. Onboarding new users, securing licenses, maintaining AML/KYC standards, and building regulatory trust takes time and resources.

There’s also the financing risk. Tying operational runway to crypto market cycles—via Bitcoin-backed credit lines—creates a dependency that can be both a strength and a vulnerability. A bull market could supercharge the project. A correction could tighten liquidity.

But Exodus seems prepared to manage these variables, signaling confidence not just in crypto’s long-term growth, but in its own ability to lead the transition from speculative assets to everyday utility.

What it means for the industry

This acquisition is more than just M&A. It’s an evolution in crypto’s UX. If Exodus can successfully build a wallet that handles custody, compliance, payments, and user experience under one roof, it may set the standard for a new category of fintech.

It could also pressure traditional banks and fintechs to integrate crypto more deeply, or risk being leapfrogged by crypto-native services that offer better speed, lower fees, and superior global access.

Final thoughts

Exodus isn’t just adding features—it’s laying down rails for a self-sovereign financial system. The acquisition of W3C may look like a backend infrastructure play, but it’s really a front-end transformation of how people use money. Wallets are no longer just vaults. They’re becoming launchpads.

Blockchain & DeFi

When DeFi Becomes Finance: How Token Buybacks Are Reshaping Governance at Uniswap, Lido and Aave

The decentralized‑finance sector is increasingly borrowing cues from Wall Street: protocols such as Uniswap, Lido and Aave are deploying token‑buyback strategies that mirror corporate stock repurchases. That shift may come at the cost of decentralization.

From incentives to buybacks

In the early DeFi era, growth was fuelled by liquidity mining, yield farming and community token distribution. But a notable pivot is underway: Uniswap’s “UNIfication” governance proposal seeks to activate previously dormant protocol fees, route them into a treasury engine and use the proceeds to buy back and burn its native token UNI. That move shifts UNI’s role from purely governance to something closer to economic equity. Similarly, Lido has introduced a mechanism tying buybacks of its LDO token to thresholds such as Ethereum’s price and annual revenue. These initiatives signal a broader shift in DeFi from incentive‑driven issuance to revenue alignment and token scarcity.

Centralization under the hood

While buybacks may enhance token value, they also raise governance implications. When a protocol channels revenue into buybacks, decision‑making tends to centralize: fewer tokens outstanding mean fewer holders exerting power, and governance debates can shrink in scope. Uniswap’s UNIfication proposal notably transfers operational control from the community foundation to a core entity, raising questions about how decentralized the system truly remains. That change has ignited pushback from analysts who argue that concentration of power threatens the original ethos of decentralization.

Institutional logic meets decentralised platforms

These buyback programs bring traditional‑finance metrics into DeFi: concepts like yield thresholds, fee capture and token‐supply control are now front and centre. Protocols are acting less like open‑source networks and more like growth companies with value propositions. As one observer noted, the sector is moving from “free experimentation” and “cultural hype” toward “balance‑sheet clarity” and “corporate discipline.” But this evolution also ushers in tension: the community’s demand for openness and collective governance may clash with a finance‑style focus on token value and scarcity.

Risks in disguise

The financial logic is easy to follow, but the governance logic is more complex. Buybacks may temporarily boost token value, but they don’t guarantee sustainable business performance—especially in cyclic markets. Analysts caution that many of these programs rely on treasury reserves rather than recurring revenue streams, which may leave protocols vulnerable in a downturn. More fundamentally, allocating large sums to buybacks can deprioritise innovation, open‑source development and liquidity growth in favour of financial engineering. Lastly, regulators may begin to interpret large token buybacks as dividend‑like distributions, posing legal and compliance risks for protocols that skirt traditional securities frameworks.

What to watch

Going forward, key signals to monitor include how each protocol implements buyback mechanics: whether buybacks are triggered automatically based on transparent rules, or managed ad‑hoc by governing entities. The behaviour of token governance (voter turnout, proposal volume) will also offer insight into centralisation trends. Finally, how token value holds in a downturn will test whether these buyback models represent sustainable economic design or just gimmicks layered on top of crypto’s hype cycle.

Conclusion

The wave of token buybacks by major DeFi protocols marks a turning point. On one hand, it signifies maturation: revenue‑driven models, token‑economies aligned to business outcomes and more familiar investment frameworks. On the other hand, the shift raises core questions about decentralization, governance and the role of community in shaping protocol outcomes. As DeFi continues its evolution, the trade‑off between efficient capital models and autonomy will define the next chapter.

Blockchain & DeFi

Japan’s Banks and Regulator Move Boldly on Yen‑Stablecoin Launch

In a striking push for financial innovation, Japan’s regulatory authority has thrown its weight behind a collaborative initiative by the nation’s largest banks to launch a yen‑backed stablecoin. As Japan positions itself at the frontier of payments and digital finance, this marks a critical turning point in how traditional institutions and blockchain converge.

A new era of payments: regulator says yes

The Financial Services Agency (FSA) of Japan has officially endorsed what it calls its “Payment Innovation Project” — a scheme that brings together major banks and corporate players to issue a yen‑denominated stablecoin. According to the announcement, the project begins this month, and the immediate goal is to pilot payment‑stablecoin use among corporate clients.

Participants include Mizuho Bank, MUFG Bank (via its issuance platform “Progmat”), Sumitomo Mitsui Banking Corporation, and Mitsubishi Corporation alongside its financial arm.

The FSA emphasizes that the move responds to a broader trend: the use of blockchain technology to enhance payment systems and corporate settlement frameworks. It also indicated that after the pilot phase, results and conclusions will be published — meaning the regulator wants transparency and oversight from the start.

Why this matters

This development is significant in several key ways.

Firstly, it signals institutional acceptance of stablecoins within a regulated banking environment — not just in cryptocurrencies or niche use‑cases. By backing a yen‑stablecoin initiative, Japan is saying stablecoins deserve a seat at the table of mainstream finance.

Secondly, the collaboration among major banks matters because they serve hundreds of thousands of corporate clients in Japan. The participating banks and firms collectively serve more than 300,000 corporate users. That means this isn’t a small pilot of a handful of users; it has potential scale and could meaningfully impact corporate treasury, cross‑border settlement, and payment efficiency.

Thirdly, for the broader stablecoin and digital‑asset ecosystem, this is a signal that regulatory acceptance paired with traditional banking infrastructure may accelerate adoption. If banks issue — or co‑issue — stablecoins under the oversight of a regulator like the FSA, then the “wild‑west” narrative of crypto may shift toward “bank‑backed digital money” narratives.

Strategic implications for banks and corporates

For the banks involved, launching a stablecoin gives them a dual opportunity: one, to modernize their internal and cross‑corporate settlement operations, and two, to position themselves as platform providers for digital‑asset infrastructure rather than mere intermediaries. For corporates, the promise is lower settlement friction, more real‑time settlement (or closer), and potential cost savings.

However, this is not without challenges. The banks will need to ensure seats at the table for compliance, reporting, reserve transparency (for the coin‑backing), user protection, operational risk (smart‑contract bugs, blockchain outages, etc.), and possibly new regulatory frameworks. The FSA explicitly stressed the need to ensure users are protected and informed.

What the pilot will test and next steps

The pilot phase begins with issuance of payment‑stablecoins by the banks in question. They will likely test transactions among corporate clients, gauge settlement speed, examine cost savings, user experience, and perhaps integration with broader payment rails. Key metrics will probably include transaction volume, error/risk events, compliance overhead, effects on liquidity/reserve management, and customer uptake.

Following completion, the Japanese regulator intends to publish results and conclusions. That transparency will matter widely, as other jurisdictions and digital‑asset players will watch for lessons learned.

Broader regulatory and industry context

This initiative comes amid a broader wave of regulatory openness and crypto‑fintech experiments in Japan. The FSA and other Japanese regulators have recently been active in reviewing regulation for crypto, including considering whether banks can hold crypto, and addressing issues like insider trading in crypto markets.

Japan’s influential role here may serve as a model for other banking systems where stablecoins are considered more than speculative tokens and instead digital representations of fiat‑value for everyday payment and settlement.

Risks and considerations

Even with regulatory backing and major bank involvement, several caveats remain. It’s still early days, so operational glitches could occur — blockchain failures, integration issues with legacy systems, or unanticipated regulatory burdens. The banks will also need to navigate reserves and backing transparency: if the stablecoin is truly backed 1:1 by yen or equivalent assets, reserve audits will be important. They must also address AML/KYC and cross‑border legal issues if the stablecoin is used internationally.

Another consideration is whether corporates will adopt in meaningful volume — changing behavior from existing payment methods (bank transfers, commercial paper, etc.) takes time. And finally, competition could come from non‑bank stablecoins or global stablecoin initiatives, meaning banks must differentiate on trust, integration and regulation.

What to watch

In the coming weeks and months, it will be important to watch for when the banks issue the stablecoin, how many corporates sign up, what volume is processed, how settlement times compare to legacy methods, and whether the project expands beyond domestic corporate clients into cross‑border flows or retail use. Also of interest: how the FSA evaluation is structured and what transparency requirements are imposed.

For the crypto industry more broadly, this could signal an acceleration of tokenized fiat led by regulated banks — possibly raising the bar for stablecoin projects and redefining competition from un‑backed or lightly‑backed tokens toward bank‑backed or regulated stablecoins.

-

Cardano2 months ago

Cardano2 months agoCardano Breaks Ground in India: Trivolve Tech Launches Blockchain Forensic System on Mainnet

-

Cardano2 months ago

Cardano2 months agoCardano Reboots: What the Foundation’s New Roadmap Means for the Blockchain Race

-

Cardano2 days ago

Cardano2 days agoSolana co‑founder publicly backs Cardano — signaling rare cross‑chain respect after 2025 chain‑split recovery

-

Bitcoin2 months ago

Bitcoin2 months agoQuantum Timebomb: Is Bitcoin’s Foundation About to Crack?

-

Cardano2 months ago

Cardano2 months agoAfter the Smoke Clears: Cardano, Vouchers, and the Vindication of Charles Hoskinson

-

Cardano2 months ago

Cardano2 months agoMidnight and Google Cloud Join Forces to Power Privacy‑First Blockchain Infrastructure

-

Ripple2 months ago

Ripple2 months agoRipple CTO David “JoelKatz” Schwartz to Step Down by Year’s End, but Will Remain on Board

-

News2 months ago

News2 months agoRipple’s DeFi Awakening: How mXRP Is Redefining the Role of XRP