Analysis

Bitcoin’s On-Chain Pulse: What Market Cycles and Whale Metrics Reveal About the Next Move

- Share

- Tweet /data/web/virtuals/383272/virtual/www/domains/theunhashed.com/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 63

https://theunhashed.com/wp-content/uploads/2025/10/MVRVZ-1000x600.png&description=Bitcoin’s On-Chain Pulse: What Market Cycles and Whale Metrics Reveal About the Next Move', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

The Bitcoin market is sending mixed signals this week. While price action stalls near $108K, on-chain indicators are painting a more nuanced picture — one that blends cooling speculation with rising long-term conviction. From the MVRV Z-Score to NUPL and RHODL, Bitcoin’s internal health metrics are flashing clues about where we stand in the 2025 cycle.

Here’s a deep dive into what these indicators reveal — and why traders are watching them closely as the U.S. shutdown, ETF delays, and macro volatility weigh on sentiment.

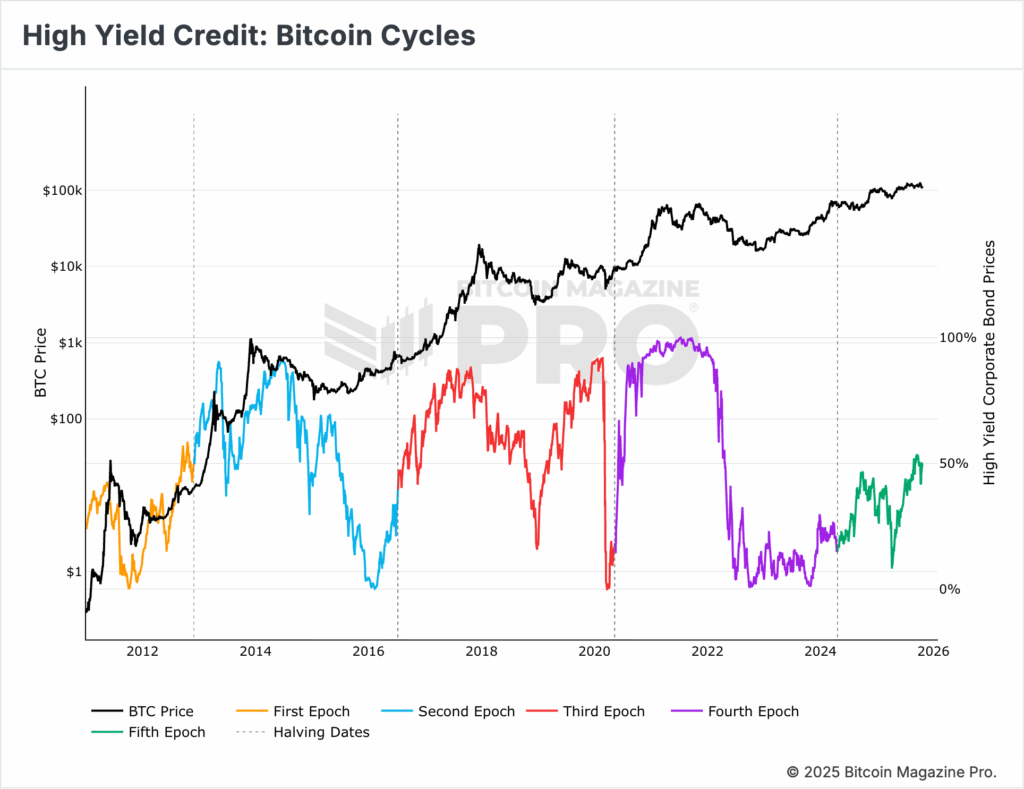

1. The Credit Cycle Connection: Risk Appetite Still Weak

Bitcoin’s latest epoch shows a fascinating link to global high-yield credit markets — a proxy for risk appetite. When investors chase yield in riskier corporate bonds, Bitcoin historically thrives. But today, that appetite remains muted.

High-yield credit prices are recovering slowly from their 2024 lows, suggesting that the global economy hasn’t fully flipped back to a risk-on environment. This matches Bitcoin’s sideways behavior: investors are cautious, waiting for a macro green light before deploying big capital.

Interpretation: If credit conditions improve — signaling that risk is back on — Bitcoin could quickly reprice higher. Until then, it’s a market running in neutral.

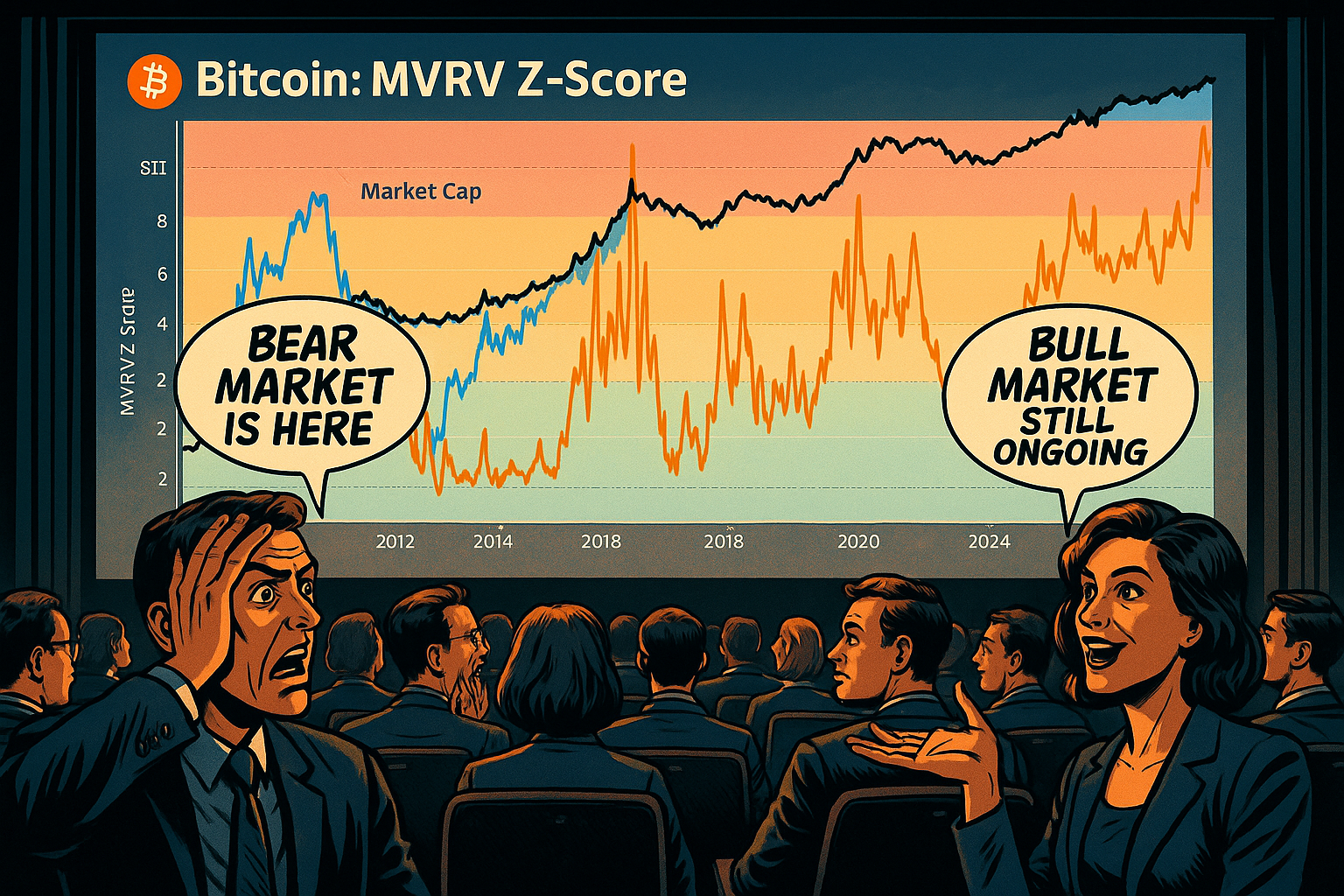

2. MVRV Z-Score: No Euphoria, No Capitulation

The MVRV Z-Score, which compares Bitcoin’s market cap to its realized cap, helps identify overbought or oversold extremes. Historically, readings above 8–10 have marked major tops, while values below 1 have indicated deep accumulation zones.

Right now, the Z-Score hovers around 2–3, a middle ground that neither screams euphoria nor despair. That suggests Bitcoin is in a mid-cycle cooling phase — the type of consolidation that has often preceded explosive upside once macro catalysts align.

Takeaway: The market isn’t overheated, but it’s far from undervalued. A period of quiet accumulation may be underway.

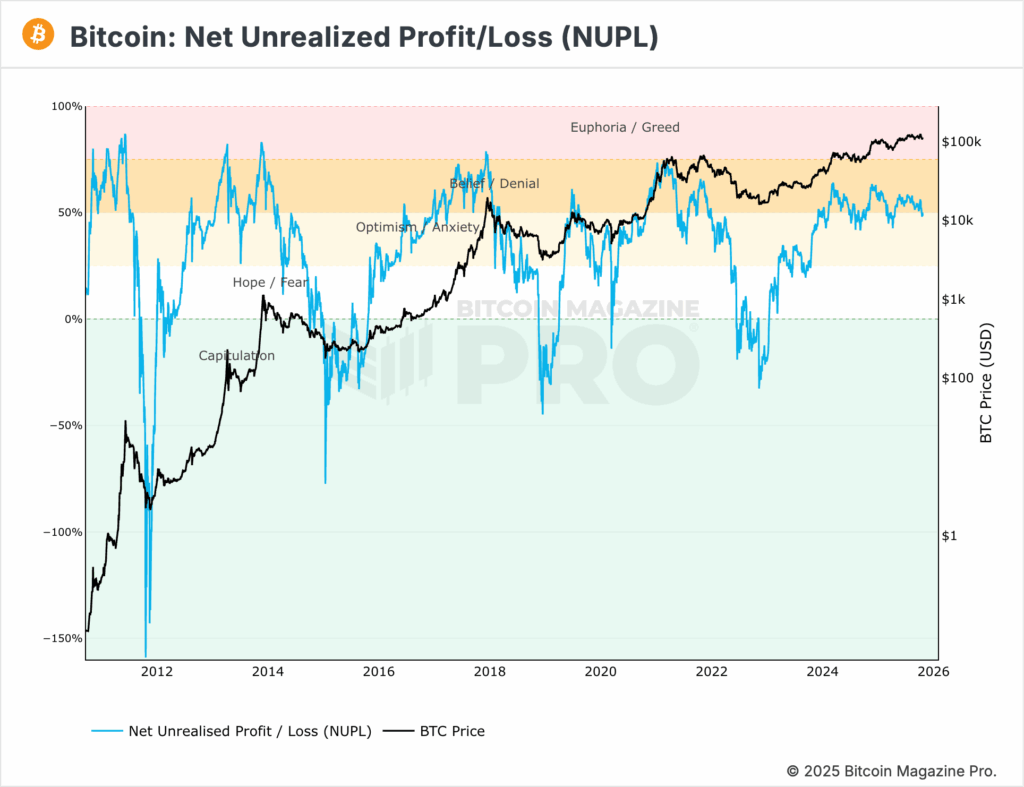

3. NUPL: From Anxiety to Belief

The Net Unrealized Profit/Loss (NUPL) indicator measures unrealized gains and losses across all wallets — effectively mapping investor psychology. It ranges from “Capitulation” to “Euphoria/Greed.”

At current readings, NUPL sits in the Optimism/Anxiety zone, meaning most holders are in profit, but not euphoric. Historically, this stage has been the prelude to belief-driven rallies — if macro and on-chain flows stay supportive.

Takeaway: Market participants are cautiously bullish. There’s conviction, but not mania.

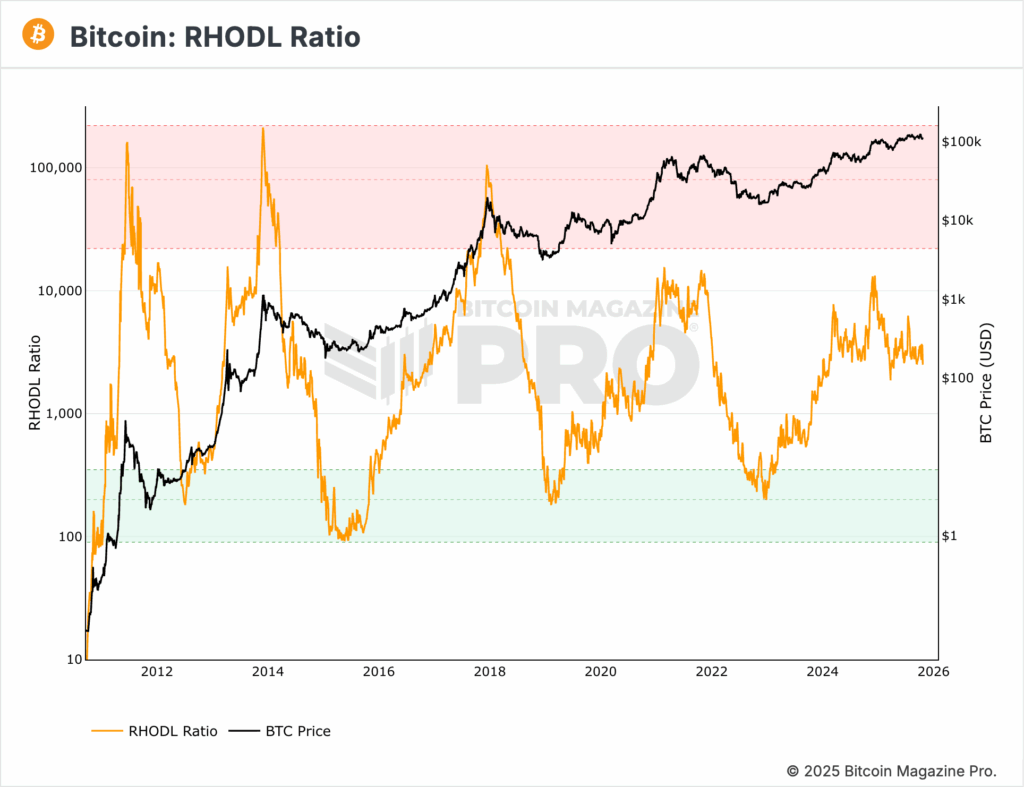

4. RHODL Ratio: Early Warning, Not Overheat

The RHODL Ratio compares the realized value of coins held for one week versus those held for one to two years. High readings mean short-term holders dominate — a sign of speculative excess.

Currently, the RHODL ratio is well below historical danger zones, suggesting that long-term holders still control most of the supply. It’s a signal of early-cycle strength, not late-cycle exhaustion.

Takeaway: Bitcoin isn’t showing the speculative spikes that typically precede a blow-off top. Long-term conviction remains strong.

5. Terminal Price: The Long-Term Ceiling

The Terminal Price model, derived from Bitcoin’s “Transferred Price,” maps where long-term holders historically start distributing. It has consistently tracked major market peaks.

As of now, Bitcoin’s spot price sits comfortably below its terminal band, implying there’s still significant upside before reaching overvaluation territory.

Takeaway: Structurally, the current market resembles a late accumulation-to-expansion phase — not a topping phase.

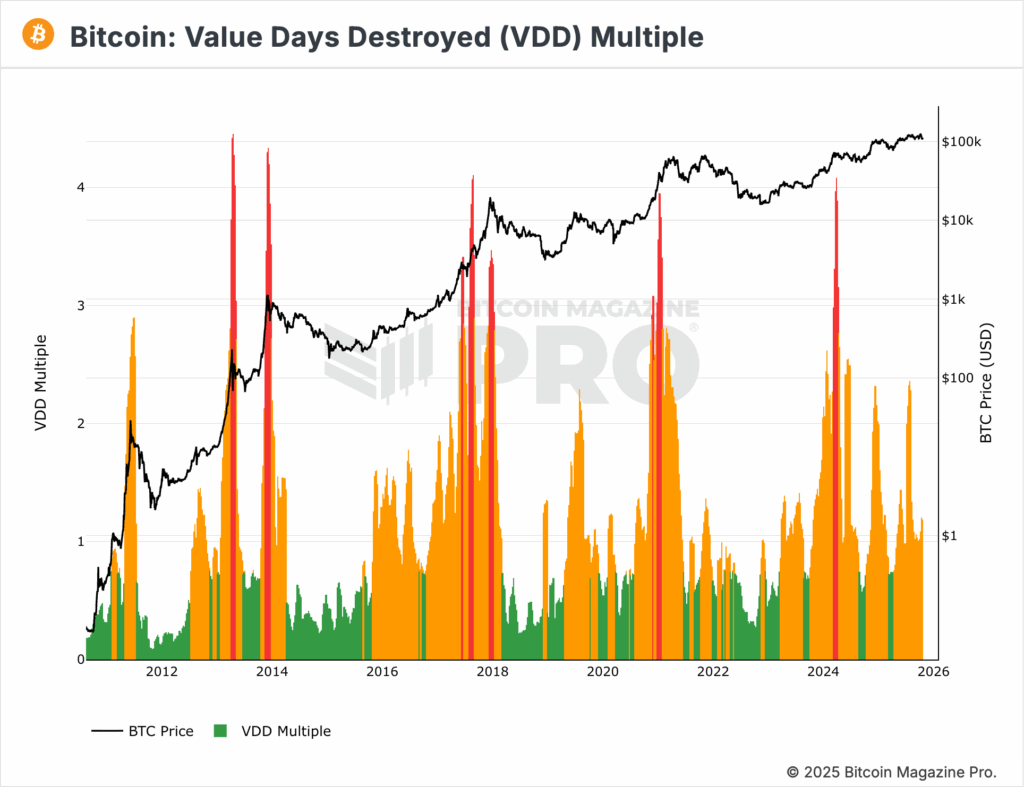

6. Value Days Destroyed (VDD) Multiple: Dormant Whales Still Quiet

The VDD Multiple, which tracks the dollar value of long-dormant coins being spent, acts as a thermometer for long-term holder activity. Red spikes historically mark profit-taking from whales near cycle tops.

Today, VDD readings are subdued, showing that old coins remain largely untouched. Whales aren’t cashing out — they’re holding.

Takeaway: Long-term holders are not signaling exit behavior yet. The market’s foundation remains stable beneath short-term volatility.

7. The Big Picture: Mid-Cycle Equilibrium

Taken together, these metrics suggest Bitcoin is in equilibrium. There’s no panic, no euphoria — just quiet consolidation under macro pressure.

- Credit markets hint that risk appetite is recovering but fragile.

- On-chain metrics like MVRV, RHODL, and NUPL point to neutral-to-bullish positioning.

- Long-term models such as Terminal Price and VDD show no top exhaustion signals.

This mirrors the mid-stage pattern of past halving cycles: a period of sideways grind that often precedes sharp revaluation once catalysts — such as ETF approvals, macro easing, or institutional inflows — ignite demand.

Final Reflection

Bitcoin’s internal pulse shows a market that’s neither overheated nor broken — simply waiting. If macro stress eases and ETF momentum resumes, the groundwork for a renewed rally is already set.

Until then, the data suggests patience, not panic. The whales are still holding, the network’s fundamentals remain strong, and the cycle’s rhythm — from accumulation to expansion — continues to unfold right on time.

All on-chain charts referenced in this analysis are sourced from Bitcoin Magazine Pro (bitcoinmagazinepro.com).

-

Cardano2 months ago

Cardano2 months agoCardano Breaks Ground in India: Trivolve Tech Launches Blockchain Forensic System on Mainnet

-

Cardano2 months ago

Cardano2 months agoCardano Reboots: What the Foundation’s New Roadmap Means for the Blockchain Race

-

Cardano2 days ago

Cardano2 days agoSolana co‑founder publicly backs Cardano — signaling rare cross‑chain respect after 2025 chain‑split recovery

-

Bitcoin2 months ago

Bitcoin2 months agoQuantum Timebomb: Is Bitcoin’s Foundation About to Crack?

-

Cardano2 months ago

Cardano2 months agoAfter the Smoke Clears: Cardano, Vouchers, and the Vindication of Charles Hoskinson

-

Cardano2 months ago

Cardano2 months agoMidnight and Google Cloud Join Forces to Power Privacy‑First Blockchain Infrastructure

-

Ripple2 months ago

Ripple2 months agoRipple CTO David “JoelKatz” Schwartz to Step Down by Year’s End, but Will Remain on Board

-

News2 months ago

News2 months agoRipple’s DeFi Awakening: How mXRP Is Redefining the Role of XRP