Cardano

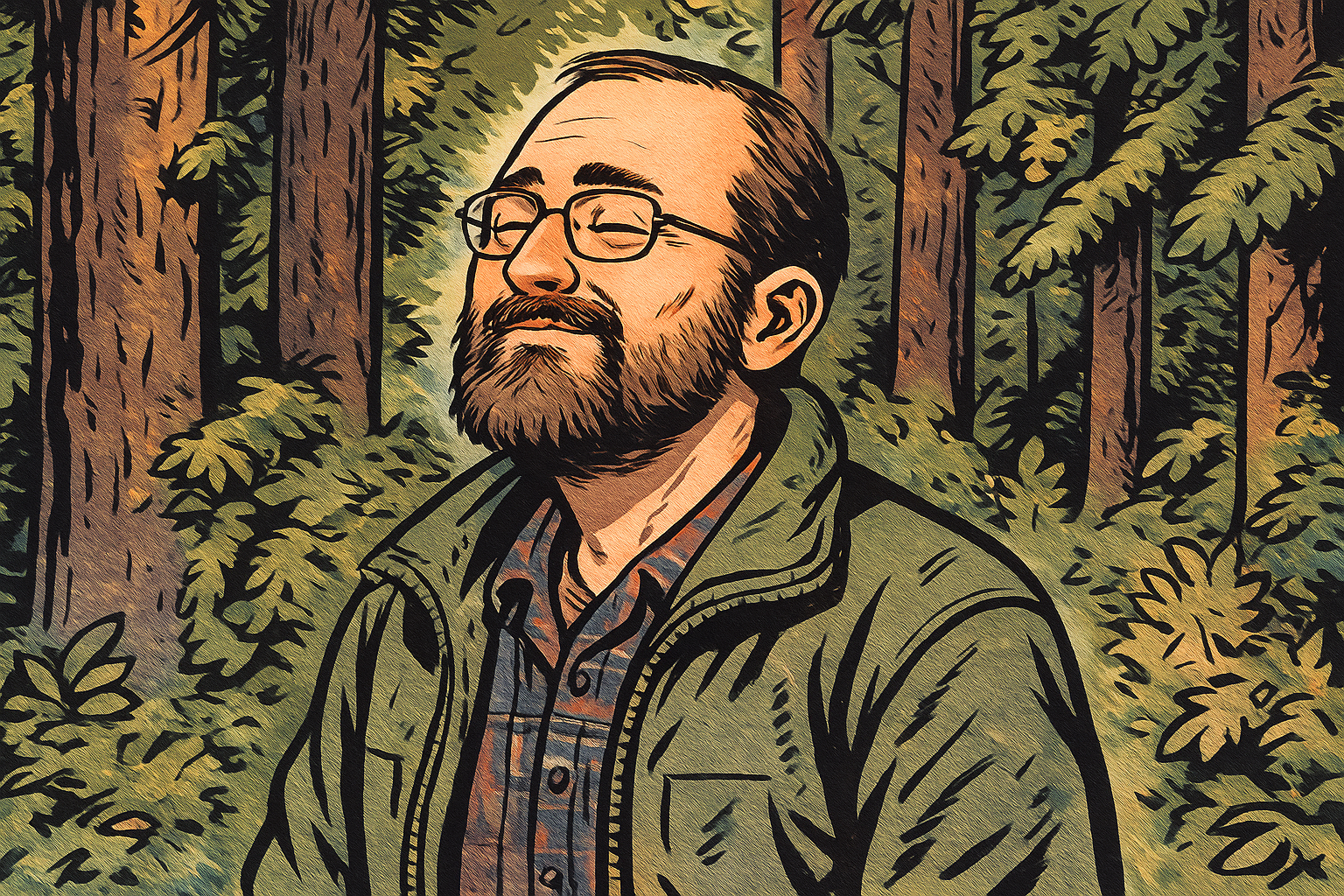

After the Smoke Clears: Cardano, Vouchers, and the Vindication of Charles Hoskinson

- Share

- Tweet /data/web/virtuals/383272/virtual/www/domains/theunhashed.com/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 63

https://theunhashed.com/wp-content/uploads/2025/09/ch-1000x600.png&description=After the Smoke Clears: Cardano, Vouchers, and the Vindication of Charles Hoskinson', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

How a once-misunderstood funding mechanism sparked crypto controversy—and how transparency ultimately prevailed

Setting the Stage: A New Vision for Blockchain

When Cardano was launched in 2017, it didn’t just enter the crowded blockchain space—it attempted to redefine it. With Charles Hoskinson at the helm, a mathematician and Ethereum co-founder known for his ambitious philosophical approach, Cardano aimed to build a decentralized financial system rooted in academic rigor, peer-reviewed research, and methodical development.

Unlike the frenzy of Initial Coin Offerings (ICOs) that defined the 2017 crypto boom, Cardano’s fundraising model stood apart. Rather than selling tokens in a typical ICO fashion, Cardano raised capital through a voucher-based sale targeted primarily at Japan. This approach was designed to meet the nuanced legal and regulatory conditions of the region, offering a level of compliance and foresight uncommon at the time.

Voucher buyers received unique redemption codes—issued by a company called Attain Corp—which could later be converted into ADA tokens once the blockchain’s infrastructure was in place. The mechanism used to handle this, called the Ada Voucher Verification Mechanism (AVVM), became an early symbol of Cardano’s commitment to transparency and user verification.

In hindsight, it was a forward-thinking system. But as with many ambitious technologies, its complexity would later become fertile ground for misinformation.

Vouchers, Upgrades, and a Long Redemption Arc

Cardano’s development roadmap was divided into carefully planned eras: Byron, Shelley, Goguen, Basho, and Voltaire. Each brought key upgrades to network functionality, decentralization, and scalability. In 2017, the Byron mainnet went live, allowing voucher holders to begin redeeming ADA. Redemption continued into the Shelley era, which launched in 2020 and introduced decentralized staking.

By this point, the overwhelming majority of ADA vouchers had been redeemed. According to later audits, more than 97% of all vouchers—representing nearly 99% of the ADA sold—had been claimed on-chain. But Cardano wasn’t done offering opportunities. Even after the automated redemption tool was disabled, IOG (formerly IOHK), the development firm behind Cardano, created a manual redemption system in 2021. This required Know Your Customer (KYC) verification, including audio and video identity checks.

Still, a small fraction of vouchers remained unredeemed. These were not ignored. In fact, IOG launched aggressive outreach campaigns, contacting potential holders via mail, email, and even in-person visits to ensure they had every opportunity to claim their tokens.

By August 2025, only a minuscule portion remained unclaimed: about 0.8% of all vouchers, equating to roughly 318 million ADA.

Enter the Controversy: 2024–2025

Despite years of transparent practices and open communication, allegations began surfacing in late 2024. The spark came from an NFT artist and social commentator named Masato Alexander, who claimed that the unredeemed ADA—valued at nearly $600 million at its peak—had been misused by insiders at IOG and related entities.

These claims gained traction on social media, spawning viral threads and sparking division within parts of the Cardano community. Five primary allegations emerged:

- That insiders had stolen or redirected unredeemed ADA.

- That the original Japanese voucher sales involved misleading or improper practices.

- That later blockchain upgrades had intentionally obstructed redemption.

- That cryptographic keys were deleted, preventing rightful claims.

- That any remaining ADA was repurposed illegally, including transfers to affiliated entities.

For a project as meticulous as Cardano, the accusations were jarring. Charles Hoskinson denied the allegations unequivocally and pledged to resolve the matter not through rhetoric, but through facts.

The Audit That Changed Everything

In May 2025, IOG commissioned a full independent forensic investigation. Two respected firms—McDermott Will & Schulte (legal) and BDO (accounting)—were brought in to audit every aspect of the voucher program, from initial sales through the latest upgrades and ADA usage.

Their 128-page report, released on September 2, 2025, delivered a clear conclusion: none of the allegations had any merit.

The findings were exhaustive. Investigators reviewed tens of thousands of documents, conducted 18 formal interviews, and performed blockchain forensic analysis. They confirmed that:

- 99.2% of vouchers and 99.7% of ADA tied to the program had been successfully redeemed.

- The Japanese sales process was lawful and transparent.

- Blockchain upgrades like Allegra and Mary did not interfere with redemptions or delete access keys.

- Vouchers used unique redemption codes—not cryptographic private keys—debunking technical claims.

- Manual redemptions continued for years and were handled with care and compliance.

- Unredeemed ADA was temporarily staked to fund redemption efforts. Later, a portion (68.2 million ADA) was transferred to Cardano Development Holdings (CDH), a Cayman trust supporting the ecosystem.

Of that amount, a smaller share—24.15 million ADA—was provided to a contractor, Input Output International, under a services agreement. All transactions were documented, transparent, and within legal bounds.

The final statement of the audit was unequivocal: “Each of the allegations related to the Topics of Investigation does not have any basis.”

The Aftermath: Trust Restored

For Charles Hoskinson and the Cardano community, the release of the audit marked the end of a disruptive chapter. A saga that had risked tarnishing the project’s reputation was now officially closed. Critics were silenced—not by counter-allegations, but by a robust, independent investigation rooted in evidence.

The controversy had one unintended silver lining: it demonstrated the maturity of Cardano’s governance. In a crypto landscape often marred by opacity and scandal, few projects invite deep audits into their historical operations. Even fewer emerge with a clean bill of health.

Looking Forward: A Future Built on Foundations

The ADA voucher saga now stands as a historical footnote—not a blemish, but a case study in how complex systems can be misunderstood, and how those misunderstandings can be resolved through transparency and verification.

Today, Cardano continues to evolve, with its ecosystem expanding into decentralized governance, smart contracts, and global financial applications. The air has been cleared, and with it, the project is free to pursue its original mission—bringing secure, decentralized finance to the world—with renewed legitimacy.

In a field where rumor often outruns fact, Cardano’s decision to confront controversy with evidence has become a blueprint for accountability in Web3.

Cardano

Solana co‑founder publicly backs Cardano — signaling rare cross‑chain respect after 2025 chain‑split recovery

From Incident to Validation

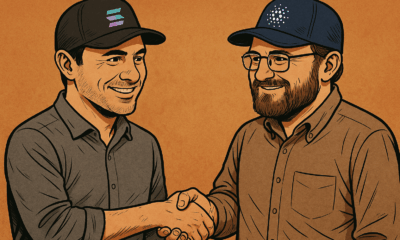

In a development that surprised many in the blockchain world, Solana co-founder Anatoly Yakovenko publicly praised Cardano following its recent chain-split incident. What could have been a blow to Cardano’s reputation instead became an unexpected moment of validation — not just from within its own ecosystem, but from one of its most prominent rivals.

The Split That Wasn’t a Stop

On November 21, 2025, Cardano experienced a technical divergence caused by a malformed transaction. The issue stemmed from a bug in the serialization and deserialization logic of its node software — a deep protocol-level vulnerability. Some nodes processed the transaction as valid, while others rejected it, resulting in two competing forks of the blockchain running simultaneously.

But here’s the critical part: Cardano never stopped. The Ouroboros consensus mechanism kept producing blocks on both forks. And once the problem was identified, developers rapidly issued a patch. Stake pool operators upgraded their nodes in a matter of hours, and the network converged back onto a single canonical chain — no hard fork, no downtime, no loss of funds.

Yakovenko’s Unexpected Endorsement

Shortly after the incident, Solana’s Anatoly Yakovenko weighed in with a surprising take. He acknowledged that creating a Nakamoto-style consensus without relying on energy-intensive Proof-of-Work is “extremely hard to build” — and concluded that Cardano “actually nailed it.” He called the network’s recovery after the split “pretty cool.”

This kind of comment matters. It wasn’t just a technical compliment — it was a recognition from a competitor that Cardano’s foundational architecture, often criticized for being slow-moving or overly academic, delivered exactly what a blockchain is supposed to do: it kept running, adapted, and healed itself.

The Design Behind the Recovery

Cardano’s recovery didn’t happen by luck. It’s the product of years of research-first development: a layered architecture, formal verification, and the Ouroboros consensus engine designed specifically to prioritize security and resilience.

Most importantly, the resolution didn’t depend on a central authority stepping in. The “honest chain” prevailed through natural consensus. Operators coordinated globally without coercion. The update rollout was swift. The split was resolved without user impact beyond brief transaction slowdowns.

These are not small feats in a decentralized environment. They represent the kind of maturity that few chains — even large ones — have demonstrated under live pressure.

A Rare Signal in Crypto Culture

What makes this moment especially significant is that it cuts through the tribalism that usually defines blockchain communities. Yakovenko didn’t take a victory lap or criticize a competitor. Instead, he acknowledged a technical achievement — one that aligns, at least in spirit, with the broader mission of blockchain: decentralized systems that can withstand failure and continue operating trustlessly.

This is a sign that the blockchain space may be maturing. Cross-chain respect, while rare, is important. It suggests a shared understanding that competition shouldn’t come at the cost of ignoring good engineering when it happens — even on another protocol.

Reframing the Narrative Around Cardano

For Cardano, the incident — and the way it was handled — may redefine public perception. The network has long been portrayed as overly cautious, academic, or “too slow to ship.” But when put to the test, those same qualities may have enabled it to respond to a complex failure without chaos.

Cardano wasn’t flawless. But when failure came, it was recoverable. And that’s the real benchmark for a network that claims to be decentralized and secure. It didn’t just protect funds. It protected trust.

Final Thought

The blockchain space has seen its share of crises: bridges exploited, blockchains halted, forks forced under pressure. But Cardano’s chain split will likely be remembered not as a breakdown — but as a breakthrough. It showed that resilience in Proof-of-Stake is not only possible, but provable. And with respect coming even from Solana’s top leadership, it’s clear that Cardano’s architecture — often underestimated — is earning its place among the most battle-ready networks in the industry.

Cardano

Cardano Has Never Stopped — What the Chain Split Really Tells Us About Its Tech

The Network Didn’t Fail. It Proved Itself.

On November 21, 2025, Cardano experienced what some feared might be a catastrophic event: a chain split. For about 14 hours, parts of the network diverged, with two versions of the blockchain running in parallel. But despite the panic and technical confusion, the result was clear—Cardano didn’t stop. The chain kept producing blocks, the network kept running, and the community coordinated a fix in real time. Far from exposing a flaw, the incident demonstrated just how solid Cardano’s architecture really is.

What Actually Happened: A Bug Meets an Edge Case

The chain split began when a malformed delegation transaction—created by an operator using AI-generated code—triggered a rarely encountered bug. The bug, which had been dormant in Cardano’s core software library since 2022, involved a discrepancy in how nodes processed transaction data during serialization and deserialization.

When this malformed transaction entered the network, some nodes interpreted it as valid while others rejected it. As a result, certain stake pool operators began building blocks on a forked version of the chain. This led to a temporary split: two incompatible chains running simultaneously.

Crucially, this was not a network halt. Cardano’s Ouroboros consensus algorithm continued to function. Blocks were still produced. Most users didn’t even notice the split until infrastructure like explorers, wallets, and exchanges began reporting inconsistencies. Transaction delays increased and around 3.3% of pending transactions were lost in the fork that was eventually discarded—but the underlying blockchain logic kept moving forward.

How Cardano Healed Itself

The recovery process was swift and decentralized. Core developers issued a patch to reject the malformed transaction type. Stake pool operators across the world upgraded quickly, voluntarily aligning with the correct version of the chain. No hard fork was required. No rollback or centralized intervention was needed. The protocol and the people around it did exactly what they were designed to do.

This recovery wasn’t just about code—it was about coordination. Cardano’s structure relies on a globally distributed group of node operators who can act independently but coherently. In this case, their rapid consensus allowed the network to self-correct in less than a day.

Why This Makes Cardano Stronger

Resilient systems aren’t the ones that never break. They’re the ones that recover quickly and accurately when they do. That’s exactly what happened here. Cardano faced a serious test, and it passed with its ledger intact and its community mobilized.

Rather than damage confidence, the event served as a validation of Cardano’s layered design and governance philosophy. It showed that even rare and difficult-to-detect bugs can be addressed within the existing framework. It also demonstrated that decentralization, when well organized, can outperform centralized systems in resilience.

Interestingly, even competitors took notice. The CEO of Solana—often seen as Cardano’s rival—publicly praised Cardano’s approach, acknowledging its strength in areas like formal verification and decentralized recovery. Such recognition from outside the ecosystem adds weight to the idea that Cardano’s fundamentals remain among the most robust in the space.

What It Means for Developers, Users, and Investors

For developers, the incident highlights the importance of safety in smart contract deployment. It also underscores the value of Cardano’s conservative, peer-reviewed approach to protocol changes. While some may criticize its pace, the trade-off for stability and recoverability is now clearer than ever.

For users, the key takeaway is trust. The network didn’t stop. Their funds remained safe. Their transactions, for the most part, were processed normally. And even when things went wrong, the fix didn’t rely on centralized authority—it relied on code and cooperation.

For investors, it signals maturity. Cardano didn’t implode. It didn’t require emergency governance. It didn’t pause block production. It endured, adapted, and continued. That’s more than can be said for many other blockchains in moments of crisis.

Final Word: Recovery Is Strength

Cardano’s chain split wasn’t a failure. It was a demonstration. It showed that robust protocol design, backed by a coordinated global community, can overcome unforeseen problems without permanent damage. No blockchain is immune to bugs—but few can claim they’ve weathered one this gracefully.

In a space where narratives often swing between hype and fear, the message from Cardano is simple and steady: even under pressure, Cardano has never stopped.

Cardano

Cardano Faces First‑Major Chain Split; Charles Hoskinson Involves FBI After Developer’s Experiment

The blockchain world was shaken when Cardano suffered a temporary yet dramatic chain split on November 21, caused by a malformed delegation transaction that exploited a bug dating back to 2022. The culprit, a staking‑pool operator working under the alias “Homer J.,” later admitted the incident began as a personal challenge — he tried to reproduce a “bad transaction,” used AI‑generated instructions and inadvertently triggered a divergence in ledger history.

What happened on the chain

The split emerged when a delegation transaction passed validation in older node versions but was rejected by newer one, causing network nodes to diverge into two incompatible chains. Block production never stopped, yet exchanges paused operations amid the confusion. Emergency patches were deployed within three hours and the system converged back to a single chain by the next day. No user funds are reported lost so far.

Hoskinson’s response and legal implications

Charles Hoskinson described the incident as a “premeditated attack” rather than a simple error and confirmed that the U.S. Federal Bureau of Investigation is investigating the matter. He asserted that the operator “knows the FBI is already involved.” Meanwhile an employee of IOHK, Cardano’s lead development organisation, publicly resigned citing concerns about future legal consequences for development mistakes.

Market and ecosystem impact

In the immediate aftermath the native token ADA dropped by as much as 16 percent before stabilising. The broader narrative now hinges on governance trust, code‑audit rigour and the growing risk that even mature proof‑of‑stake networks can be shaken by obscure legacy bugs. The debate encapsulates one of crypto’s defining tensions: decentralisation versus operational risk.

What to monitor next

Attention will focus on whether Cardano can restore stakeholder confidence and sharpen its node‑software deployment processes. Will staking‑pool‑operators upgrade swiftly to the patched version? Will governance transparency improve? Also, regulators may begin paying closer attention to blockchain network incidents being treated as cyber‑attacks. And for ADA holders and developers, the key question remains whether network resilience can outpace reputational damage.

-

Cardano2 months ago

Cardano2 months agoCardano Breaks Ground in India: Trivolve Tech Launches Blockchain Forensic System on Mainnet

-

Cardano2 months ago

Cardano2 months agoCardano Reboots: What the Foundation’s New Roadmap Means for the Blockchain Race

-

Cardano2 days ago

Cardano2 days agoSolana co‑founder publicly backs Cardano — signaling rare cross‑chain respect after 2025 chain‑split recovery

-

Bitcoin2 months ago

Bitcoin2 months agoQuantum Timebomb: Is Bitcoin’s Foundation About to Crack?

-

Cardano2 months ago

Cardano2 months agoMidnight and Google Cloud Join Forces to Power Privacy‑First Blockchain Infrastructure

-

Ripple2 months ago

Ripple2 months agoRipple CTO David “JoelKatz” Schwartz to Step Down by Year’s End, but Will Remain on Board

-

News2 months ago

News2 months agoRipple’s DeFi Awakening: How mXRP Is Redefining the Role of XRP

-

Altcoins2 months ago

Altcoins2 months agoNEAR and Cardano Forge a New Cross‑Chain Alliance: What It Means for ADA and Web3 Interoperability