News

Pump.fun Dumps $436.5 M in USDC, Native Token Tumbles 24% in a Week

- Share

- Tweet /data/web/virtuals/383272/virtual/www/domains/theunhashed.com/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 63

https://theunhashed.com/wp-content/uploads/2025/11/pump_fun_solana-1000x600.png&description=Pump.fun Dumps $436.5 M in USDC, Native Token Tumbles 24% in a Week', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

In a startling turn of events, the memecoin‑launchpad platform known as Pump.fun (PUMP) has triggered alarms across its ecosystem. According to on‑chain data aggregated by independent analysts, the platform has moved roughly $436.5 million USDC since mid‑October, most of it flowing through the exchange Kraken and onward to Circle — raising serious questions about liquidity management, token holder incentives, and long‑term viability. The PUMP token has simultaneously fallen about 24 percent over the past week, triggering a sharp decline in investor confidence. The underlying narrative hints at a classic cash‑out move from insiders, wounding market sentiment in the process.

What exactly happened?

The platform launched its native PUMP token in July, raising roughly $500 million in under 12 minutes during its initial offering. A portion of those funds came from a June institutional private sale. Now, the data show that the project has moved large sums out of its ecosystem. Between October 15 and the current date, the project deposited approximately $436.5 million USDC into Kraken, then transferred around $537.6 million USDC from Kraken to Circle. Over a longer timeframe, from May 2024 to August 2025, the team sold about 4.19 million SOL tokens — worth approximately $757 million — including around 264,373 SOL (about $41.6 million) that were dumped on‑chain.

In short, a large chunk of the ecosystem’s funds appears to have been moved out rather than reinvested, raising red flags for token holders.

Why this matters — and why people are concerned

When a project moves hundreds of millions of dollars of stablecoin out of an ecosystem so rapidly, the market reads this as one of several possible signs: insiders extracting value, risk of liquidity drain, or an exit strategy in motion. For holders of PUMP, several risk signals now combine to dim optimism.

The token is trading at approximately $0.0026, which is lower than the June institutional sale price of $0.004. The mantra of growth and token launch activity touted by the platform — such as a newly introduced “Mayhem Mode,” an AI‑driven token launch feature — has failed to significantly improve underlying metrics. Daily token launches rose only marginally from around 17,300 to 17,800. Meanwhile, community sentiment is souring. Messages like “No airdrop, no marketing, no incentives” reflect users’ frustration that the team has not visibly reinvested into ecosystem growth despite extracting large funds. The week‑on‑week price drop of roughly 24 percent reflects that market participants are adjusting expectations downward.

For a project dependent on continuous launch‑activity and token holder confidence, this sort of cash‑out and perceived neglect can be deadly.

Broader implications for memecoin launchpads and tokens

The case of Pump.fun is a cautionary tale — not just for this project but for the broader category of memecoin launchpads and ecosystem‑tokens. When a platform promises high‑velocity launch activity, token utility, and community returns but simultaneously has internal profit‑taking and opaque fund flow, the risk of a sharp jolt to confidence increases.

Token‑holders looking for sustainable value in this niche ought to watch for transparency of fund flows, demonstrable reinvestment into ecosystem growth, real usage metrics beyond hype features, and tokenomics that align insiders’ incentives with long‑term holders rather than short‑term extractions.

In the case of Pump.fun, the massive outflow of USDC without clear reinvestment raises questions whether the launchpad model is sustainable or simply built around short‑term pump and cash‑out cycles.

What to watch going forward

Several events over the coming weeks will likely determine whether this becomes a textbook collapse or whether the project recovers trust.

It remains to be seen whether the team will address the large fund movements with an explanation, possibly unlocking part of the funds for ecosystem growth or token‑holder benefit. The PUMP token will also need to demonstrate a rebound in activity — including launches, volume, and new users — that justifies the prior hype. Additionally, centralized exchanges such as Kraken and stablecoin issuers like Circle may come under scrutiny if regulators start raising flags about large sudden stablecoin flows linked to high‑risk token ecosystems. Finally, the broader market conditions for memecoins and launchpads will be important: this incident could either signal a broader trend of capital flight or remain a localized warning.

In short, Pump.fun’s large‑scale dollar extraction and the steep drop in its native token’s value suggest that launchpad tokens remain a high‑risk segment. Token‑holders in such ecosystems must remain extra vigilant about fund flows and alignment of incentives.

Ethereum

Small Kingdom, Big Move — Bhutan Stakes $970 K of ETH via Figment to Back National Blockchain Ambitions

Bhutan Turns Heads With Institutional‑Grade ETH Stake

The government of Bhutan quietly moved 320 ETH — worth roughly $970,000 — to Figment, the well-known staking provider, signaling a major shift in how the Himalayan kingdom engages with crypto. Rather than a speculative or retail‑style buy, this is an institutional‑level stake: the amount deployed corresponds to 10 full Ethereum validators (since each validator requires 32 ETH).

More Than Just Yield: Bhutan Anchors Crypto in Governance

Bhutan’s ETH stake comes on the heels of a far broader crypto‑adoption push. In October 2025 the country launched a sovereign national digital identity system — built not on a private chain, but on the public Ethereum blockchain. The decision to anchor citizen identities on a decentralized, globally supported network like Ethereum underscores a long‑term vision: decentralized identity, on‑chain transparency, and national infrastructure built with blockchain.

For Bhutan, this ETH stake isn’t about short‑term price swings or hype — it reflects a strategic bet on Proof‑of‑Stake infrastructure. By running validators via Figment, the government contributes to network security, potentially earns rewards, and aligns its own holdings and governance systems with the protocols underlying its digital‑ID rollout.

What This Signals for Ethereum — and for Crypto Governance

Though 320 ETH is a drop in the bucket compared to total staked ETH globally, the move carries symbolic weight. A sovereign state publicly committing funds to ETH staking via a recognized institutional provider adds to the broader narrative: that Proof‑of‑Stake networks are maturing, and that blockchain can underpin more than speculative assets — it can support identity, governance, and long-term infrastructure.

Moreover, it highlights that institutional staking services like Figment are increasingly trusted not only by hedge funds or corporations, but by governments. According to Figment’s own data, their Q3 2025 validator participation rate stood at 99.9%, and they reported zero slashing events — underlining the reliability such clients are counting on.

What to Watch Next

Will Bhutan stake more ETH? On‑chain data shows the wallet still holds a portion of ETH that remains unstaked — suggesting potential for future validator additions.

Will other nations follow suit? If Bhutan’s mixed use of crypto — combining reserve assets, public‑service infrastructure, and staking — proves viable, it could serve as a blueprint for other smaller states looking to modernize governance with blockchain.

Will this affect ETH’s valuation? Hard to say immediately. The 320 ETH is unlikely to move market prices by itself. But if this step becomes part of a larger trend toward institutional and sovereign staking, the cumulative effect on demand and network security could indirectly support ETH’s long-term value proposition.

Altcoins

Meme Coins Are Losing Their Mojo — From 20 % of Crypto Buzz to Just 2.5 % This Year

Meme‑Coin Hype Takes a Hard Hit

A recent report shows that collective interest in meme coins has plunged from about 20 % of all crypto chatter in late 2024 to roughly 2.5 % by October 2025 — a collapse of nearly 90 %. This shift reflects not only a drop in social buzz but also a broader retreat of speculative enthusiasm across the market. What once felt like the wild west of crypto — rapid launches, viral marketing and huge price swings — is cooling fast.

Market Metrics Confirm the Slide

The decline isn’t just anecdotal. Over the past year, more than 13 million meme tokens flooded the market, many with little to no utility — and most quickly vanished or failed. In a sector built on hype, many of these coins turned out to be short‑lived bets. Overall, the fully diluted market capitalization of memes has dropped by nearly 50 % year‑to‑date, according to blockchain analytics firms.

Trading volume has also cratered. In the first quarter of 2025, memecoin trading volume reportedly fell by 63 %. In many markets, memecoins’ share of overall trading volume dropped below 4 %, marking a dramatic retreat from their previous prominence.

What’s Driving the Decline

The collapse appears driven by a mix of oversaturation, weak fundamentals, and shifting investor preference. The meme‑coin ecosystem became overcrowded — tens of millions of projects launched, many with no clear roadmap or utility beyond chasing quick returns. That oversupply, combined with a broader crypto market slump, has wreaked havoc on liquidity and investor confidence.

Some analysts also cite growing regulatory scrutiny and a rising demand for real utility and transparency rather than hype‑driven “get‑rich‑quick” schemes. Meanwhile, capital and attention are rotating toward more tangible crypto sectors — such as AI‑powered tokens, infrastructure projects, DeFi, privacy coins and even traditional‑finance–style crypto instruments.

Could This Be a “Generational Bottom”?

Some within the community argue that the crash may bottom out soon — and that a new cycle could follow. Once the “dead weight” of unsustainable projects is cleared out, more serious, utility‑driven tokens could regain attention. Others believe the meme‑coin era may be effectively over — that the speculative mania has dissipated, and unless a meme coin brings real innovation or value, investors will avoid it.

Broader Implications for Crypto Markets

The downfall of meme coins underscores a broader maturation of the crypto industry in 2025. Markets appear to be shedding excess speculation and gravitating toward assets with fundamentals. This could lead to healthier ecosystem growth, better token design, and more sustainable long‑term investment — but also less room for high‑risk, high‑reward “moonshot” plays that defined crypto’s early years.

Altcoins

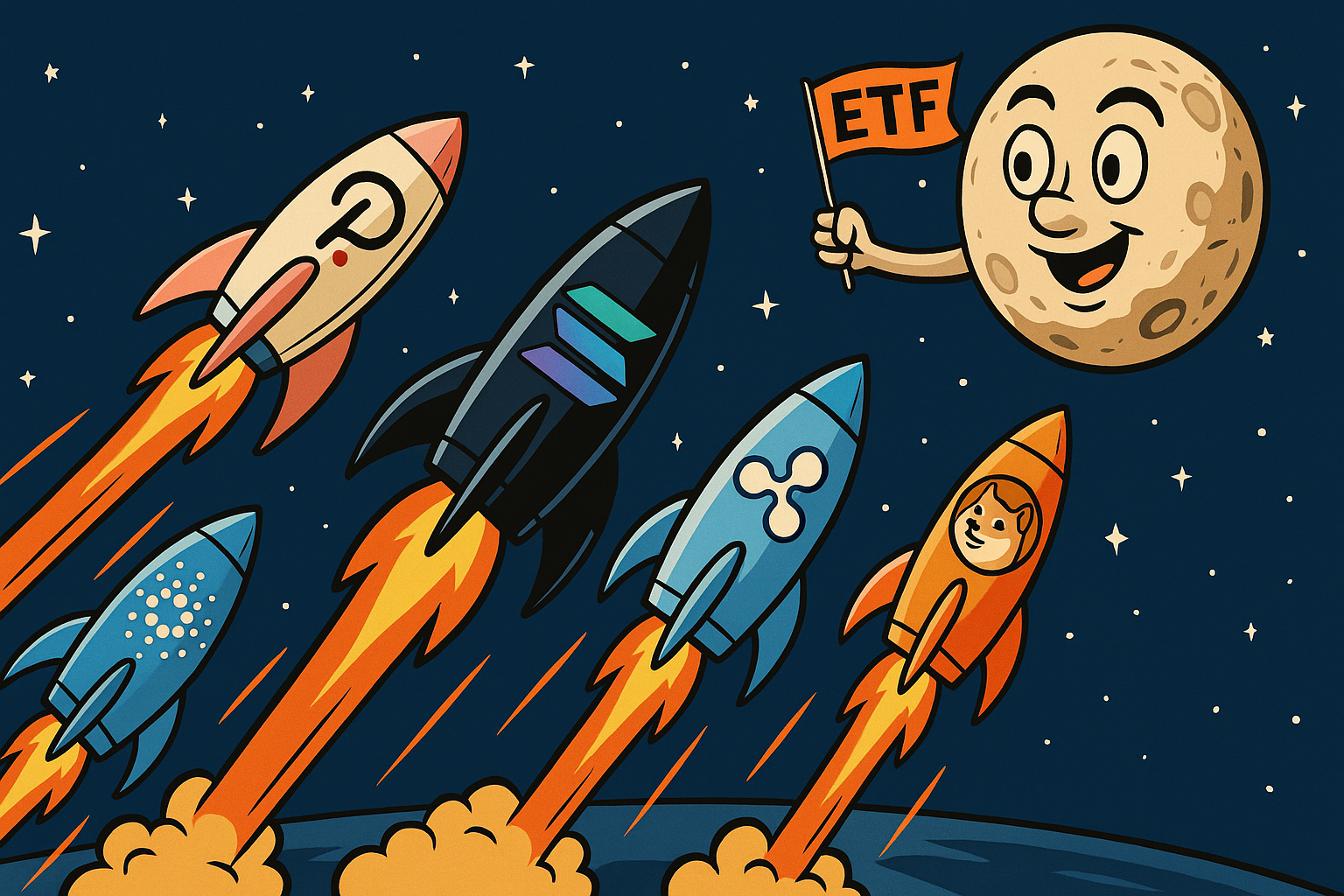

NYSE Arca Files to Launch Altcoin-Focused ETF

Fresh Rule‑Change Proposal Seeks Green Light From SEC

A fresh proposal filed by NYSE Arca could soon bring a new kind of cryptocurrency investment product to the U.S. market. In partnership with asset management giant T. Rowe Price, the exchange is seeking regulatory approval to list an actively managed crypto ETF that goes beyond Bitcoin and Ethereum. If approved, the fund would give investors exposure to a mix of top altcoins—like Solana, XRP, Cardano, and more—through a traditional stock exchange, eliminating the need for wallets, private keys, or crypto trading accounts.

What the Fund Would Do: A Broad, Actively‑Managed Crypto Basket

The Fund isn’t a passive single‑asset product but aims for active management. Its objective is to outperform the FTSE Crypto US Listed Index over the long term.

At launch the Fund intends to hold a diversified basket of “Eligible Assets,” which currently include major tokens such as Bitcoin (BTC), Ether (ETH), Solana (SOL), XRP, Cardano (ADA), Avalanche (AVAX), Litecoin (LTC), Polkadot (DOT), Dogecoin (DOGE), Hedera (HBAR), Bitcoin Cash (BCH), Chainlink (LINK), Stellar (XLM), and Shiba Inu (SHIB).

The Fund may hold as few as five, or as many as fifteen, crypto assets at any given time — and is not strictly tied to the index’s weighting. It may over‑ or underweight certain assets, or include crypto outside the index, guided by active selection criteria such as valuations, momentum and fundamental factors.

The idea is to give investors exposure to a diversified crypto portfolio without having to manage wallets, custody, and rebalancing — while potentially delivering better returns than a static, index‑tracking fund.

Risk Controls, Custody and Governance

To ensure safety and regulatory compliance, the Fund will store its crypto holdings with a dedicated crypto custodian. Private keys will be secured under strict controls, preventing unauthorized access or misuse.

When the Fund stakes any crypto (if staking is employed), it will maintain policies to ensure sufficient liquidity to meet redemptions, especially if a large portion of assets becomes illiquid or locked.

Valuation of the crypto holdings — used to compute Net Asset Value (NAV) per share — will rely on reference rates from third‑party price providers, aggregated across multiple platforms. The NAV will be computed daily, aligned with close of trading on the Exchange or 4:00 p.m. E.T.

Why It Matters for Crypto and Traditional Finance

This filing reflects a broader shift in traditional financial markets embracing diversified, regulated crypto investment vehicles. Unlike earlier spot‑crypto ETFs designed for single assets (e.g., Bitcoin), this Fund proposes a multi‑asset, actively managed basket — potentially appealing to institutional investors and diversified‑portfolio allocators seeking crypto exposure with traditional ETF convenience.

If approved, the Fund would offer a streamlined, compliance‑friendly bridge between traditional capital markets and crypto assets, lowering operational friction for investors who prefer not to deal with wallets, exchanges, or self‑custody.

The approach may also set a precedent: showing that active crypto ETFs can meet listing standards under rules originally written for commodity‑based trusts. This could open the door for more innovation — perhaps funds targeting niche themes (smart‑contract tokens, layer‑2s, tokenized real‑assets) while still abiding by exchange and regulatory requirements.

What’s Next

The SEC review period typically spans up to 45 days from publication (or longer if extended), during which comments from market participants and the public may shape the final decision.

If approved, it may take some additional time before shares begin trading — during which documents like the fund’s prospectus, ETF symbol, and listing date will be finalized and disclosed by the sponsor.

-

Cardano2 months ago

Cardano2 months agoCardano Breaks Ground in India: Trivolve Tech Launches Blockchain Forensic System on Mainnet

-

Cardano2 months ago

Cardano2 months agoCardano Reboots: What the Foundation’s New Roadmap Means for the Blockchain Race

-

Cardano2 days ago

Cardano2 days agoSolana co‑founder publicly backs Cardano — signaling rare cross‑chain respect after 2025 chain‑split recovery

-

Bitcoin2 months ago

Bitcoin2 months agoQuantum Timebomb: Is Bitcoin’s Foundation About to Crack?

-

Cardano2 months ago

Cardano2 months agoAfter the Smoke Clears: Cardano, Vouchers, and the Vindication of Charles Hoskinson

-

Cardano2 months ago

Cardano2 months agoMidnight and Google Cloud Join Forces to Power Privacy‑First Blockchain Infrastructure

-

Ripple2 months ago

Ripple2 months agoRipple CTO David “JoelKatz” Schwartz to Step Down by Year’s End, but Will Remain on Board

-

News2 months ago

News2 months agoRipple’s DeFi Awakening: How mXRP Is Redefining the Role of XRP