Blockchain & DeFi

Stablecoins Push Banks to Pay Up: Stripe CEO Predicts Yield Revolution

- Share

- Tweet /data/web/virtuals/383272/virtual/www/domains/theunhashed.com/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 63

https://theunhashed.com/wp-content/uploads/2025/10/stripe2-1000x600.png&description=Stablecoins Push Banks to Pay Up: Stripe CEO Predicts Yield Revolution', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

In a world where depositing money in a savings account often means earning near‑zero interest, stablecoins are quietly rewriting the rules. Patrick Collison, co‑founder and CEO of payments firm Stripe, argues the rise of yield‑bearing stablecoins will force traditional banks and financial institutions to offer real returns to depositors—or risk becoming obsolete.

The Low‑Rate Status Quo

Across the U.S. and Europe, savers currently receive puny yields. In the U.S., average bank savings accounts yield around 0.40 %. In the EU, the average is even lower—somewhere near 0.25 %. These rates often lag inflation, meaning depositors lose purchasing power over time.

This stingy interest environment has long acted as a friction point: how do financial intermediaries attract and retain deposits when capital markets or crypto instruments can deliver more attractive yields?

Enter Yield‑Bearing Stablecoins

Stablecoins—digital tokens intended to track fiat currencies like the dollar or euro—are increasingly being structured to deliver yield. These tokens can be backed by lending, yield‑generating financial protocols, or interest‑bearing instruments in decentralized finance (DeFi). Collison sees this as a tipping point: once consumers realize they can earn “real” returns via stablecoins, they’ll question why legacy banks don’t offer similar terms.

In Collison’s view, “depositors are going to, and should, earn something closer to a market return on their capital.” He calls the current model—where banks pay almost nothing—“consumer‑hostile” and unsustainable.

He also warned of lobbying efforts aiming to restrict yield‑bearing functionality in stablecoins—measures that would blunt this pressure on traditional finance.

Regulatory Crosswinds: GENIUS and Yield Limits

Stablecoin growth is already caught in a regulatory tug‑of‑war. In the United States, the GENIUS bill (a stablecoin regulatory framework) aims to bring stability and oversight—yet it also curtails certain yield‑sharing provisions.

Banking lobbyists have long opposed giving stablecoin issuers interest‑paying capabilities, warning that such competition could siphon deposits away from conventional institutions. As Senator Kirsten Gillibrand voiced during legislative debates, “if stablecoins can issue interest, there’s no reason to put your money in a local bank.”

Despite this opposition, crypto and fintech insiders foresee a future where stablecoins subsume traditional currency rails entirely. As Tether co‑founder Reeve Collins put it: “All currency will be a stablecoin … It’ll just be called dollars, euros, or yen.”

Why This Could Force a Banking Overhaul

If Collison’s thesis plays out, the implications for legacy finance are profound:

- Margin pressure on banks. Traditional banks earn money by borrowing (via deposits) at low rates and lending at higher ones. If deposit rates must rise, margin compressions could hit many banks hard.

- Reevaluation of risk models. To pay higher interest, institutions may need to take on or manage yield-bearing assets more aggressively, introducing new credit or counterparty risks.

- Competition for capital. Depositors might prefer crypto‑native or hybrid instruments that offer better transparency and yield, forcing banks to innovate or lose market share.

- Regulation as a battlefield. Political and regulatory forces may become the primary leverage point—limiting how much yield stablecoins can share, what risk they can assume, and how they interface with the banking system.

Challenges & Unknowns

Of course, Collison’s vision is not guaranteed. Some key headwinds:

- Counterparty and smart contract risk. Yield generation in DeFi or algorithmic protocols can be volatile or insecure. A stablecoin promising yield is only as strong as its underlying mechanisms.

- Regulatory uncertainty. Governments may stiffly resist letting “currency tokens” offer interest. ZIP‑style constraints or outright bans could emerge.

- Adoption friction. For many, the idea of using stablecoins is still novel, and regulatory or technological overhead might dampen mass uptake.

- Liquidity and stability. High yields can attract speculation, which may stress peg stability or liquidity buffers.

A New Impetus for Financial Evolution

Collison’s core argument is simple but disruptive: once money itself (in stablecoin form) becomes yield‑bearing, all players in the financial landscape—including banks—must adapt or be outcompeted. The rise of yield‑sharing stablecoins could force traditional institutions to rethink decades of business models founded on low deposit rates and high loan spreads.

Whether this becomes a revolution or a regulatory standoff remains to be seen. But it’s clear that stablecoins are no longer niche crypto novelties—they are pushing at the boundaries of how modern finance works.

Blockchain & DeFi

Exodus Goes Full Stack: Wallet Giant Acquires W3C to Dominate Crypto Payments

In a major leap toward integrating self-custody wallets with everyday finance, Exodus Movement has signed a $175 million deal to acquire W3C Corp, the parent company of crypto-friendly payment providers Baanx and Monavate. The acquisition puts Exodus squarely on the path to becoming a vertically integrated player in the crypto payments ecosystem—controlling everything from asset storage to transaction rails.

Wallet meets payments infrastructure

Exodus has built its brand on providing sleek, user-friendly wallets that give users full custody of their digital assets. But this move signals a new ambition: to turn those wallets into true financial hubs, enabling users not only to hold crypto but to spend it with the same ease as fiat currency.

With Baanx and Monavate now under its umbrella, Exodus gains direct access to critical infrastructure like card issuing, transaction processing, and compliance frameworks. That means Exodus users could soon swipe a debit card backed directly by their on-chain assets, or access stablecoin payments seamlessly integrated into the app.

This isn’t about being another crypto wallet. It’s about being the first wallet that also functions like a bank.

Terms of the deal and financing

The acquisition, expected to close in early 2026, is financed through a mix of cash and credit. Exodus is securing funding via a lending facility with Galaxy Digital, backed in part by its Bitcoin holdings. This is both a savvy move and a calculated risk—using crypto collateral in a volatile market can amplify upside, but also exposes the company to market drawdowns.

Still, the message is clear: Exodus is betting on Bitcoin long term, and is leveraging its own balance sheet to double down on crypto-native financial infrastructure.

Strategic shift: from holding to spending

What makes this deal so significant is the directional shift it signals. Most wallets—hardware or software—have stopped short of solving the everyday usability problem. People can hold assets, but spending them usually requires off-ramping through exchanges, third-party cards, or custodians.

By contrast, Exodus now controls a vertically integrated stack that could take a user from cold storage to tap-to-pay in seconds. If executed well, it could mark a major evolution in self-custody—from a niche security practice to a full-featured alternative to traditional banking.

It also opens the door to stablecoin integration, programmable payments, and more advanced DeFi access—all without compromising user control of private keys.

Risk profile: market exposure and compliance

Of course, there are headwinds. The integration of payments infrastructure is complex, especially in jurisdictions where financial compliance is stringent and ever-changing. Onboarding new users, securing licenses, maintaining AML/KYC standards, and building regulatory trust takes time and resources.

There’s also the financing risk. Tying operational runway to crypto market cycles—via Bitcoin-backed credit lines—creates a dependency that can be both a strength and a vulnerability. A bull market could supercharge the project. A correction could tighten liquidity.

But Exodus seems prepared to manage these variables, signaling confidence not just in crypto’s long-term growth, but in its own ability to lead the transition from speculative assets to everyday utility.

What it means for the industry

This acquisition is more than just M&A. It’s an evolution in crypto’s UX. If Exodus can successfully build a wallet that handles custody, compliance, payments, and user experience under one roof, it may set the standard for a new category of fintech.

It could also pressure traditional banks and fintechs to integrate crypto more deeply, or risk being leapfrogged by crypto-native services that offer better speed, lower fees, and superior global access.

Final thoughts

Exodus isn’t just adding features—it’s laying down rails for a self-sovereign financial system. The acquisition of W3C may look like a backend infrastructure play, but it’s really a front-end transformation of how people use money. Wallets are no longer just vaults. They’re becoming launchpads.

Blockchain & DeFi

When DeFi Becomes Finance: How Token Buybacks Are Reshaping Governance at Uniswap, Lido and Aave

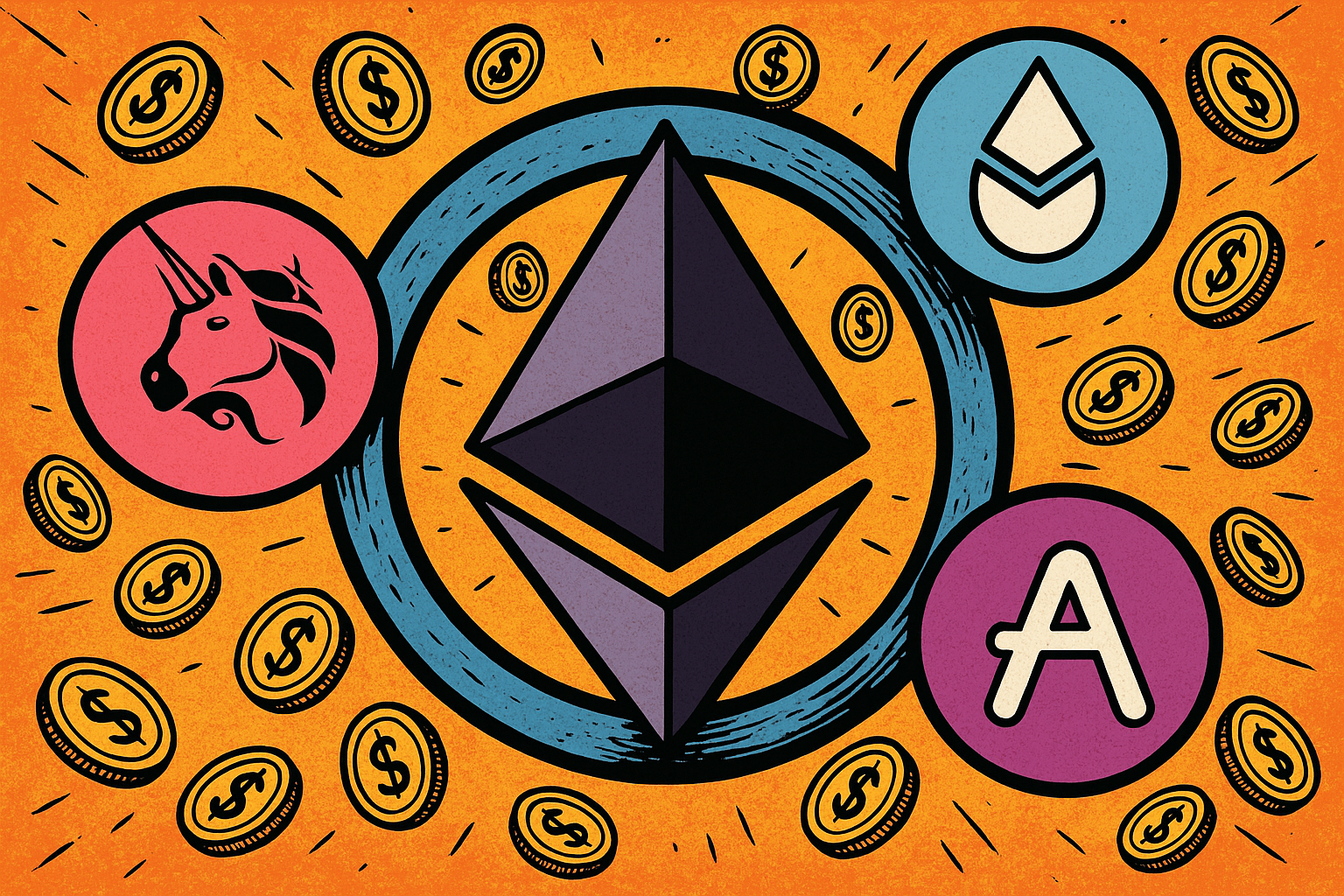

The decentralized‑finance sector is increasingly borrowing cues from Wall Street: protocols such as Uniswap, Lido and Aave are deploying token‑buyback strategies that mirror corporate stock repurchases. That shift may come at the cost of decentralization.

From incentives to buybacks

In the early DeFi era, growth was fuelled by liquidity mining, yield farming and community token distribution. But a notable pivot is underway: Uniswap’s “UNIfication” governance proposal seeks to activate previously dormant protocol fees, route them into a treasury engine and use the proceeds to buy back and burn its native token UNI. That move shifts UNI’s role from purely governance to something closer to economic equity. Similarly, Lido has introduced a mechanism tying buybacks of its LDO token to thresholds such as Ethereum’s price and annual revenue. These initiatives signal a broader shift in DeFi from incentive‑driven issuance to revenue alignment and token scarcity.

Centralization under the hood

While buybacks may enhance token value, they also raise governance implications. When a protocol channels revenue into buybacks, decision‑making tends to centralize: fewer tokens outstanding mean fewer holders exerting power, and governance debates can shrink in scope. Uniswap’s UNIfication proposal notably transfers operational control from the community foundation to a core entity, raising questions about how decentralized the system truly remains. That change has ignited pushback from analysts who argue that concentration of power threatens the original ethos of decentralization.

Institutional logic meets decentralised platforms

These buyback programs bring traditional‑finance metrics into DeFi: concepts like yield thresholds, fee capture and token‐supply control are now front and centre. Protocols are acting less like open‑source networks and more like growth companies with value propositions. As one observer noted, the sector is moving from “free experimentation” and “cultural hype” toward “balance‑sheet clarity” and “corporate discipline.” But this evolution also ushers in tension: the community’s demand for openness and collective governance may clash with a finance‑style focus on token value and scarcity.

Risks in disguise

The financial logic is easy to follow, but the governance logic is more complex. Buybacks may temporarily boost token value, but they don’t guarantee sustainable business performance—especially in cyclic markets. Analysts caution that many of these programs rely on treasury reserves rather than recurring revenue streams, which may leave protocols vulnerable in a downturn. More fundamentally, allocating large sums to buybacks can deprioritise innovation, open‑source development and liquidity growth in favour of financial engineering. Lastly, regulators may begin to interpret large token buybacks as dividend‑like distributions, posing legal and compliance risks for protocols that skirt traditional securities frameworks.

What to watch

Going forward, key signals to monitor include how each protocol implements buyback mechanics: whether buybacks are triggered automatically based on transparent rules, or managed ad‑hoc by governing entities. The behaviour of token governance (voter turnout, proposal volume) will also offer insight into centralisation trends. Finally, how token value holds in a downturn will test whether these buyback models represent sustainable economic design or just gimmicks layered on top of crypto’s hype cycle.

Conclusion

The wave of token buybacks by major DeFi protocols marks a turning point. On one hand, it signifies maturation: revenue‑driven models, token‑economies aligned to business outcomes and more familiar investment frameworks. On the other hand, the shift raises core questions about decentralization, governance and the role of community in shaping protocol outcomes. As DeFi continues its evolution, the trade‑off between efficient capital models and autonomy will define the next chapter.

Blockchain & DeFi

Japan’s Banks and Regulator Move Boldly on Yen‑Stablecoin Launch

In a striking push for financial innovation, Japan’s regulatory authority has thrown its weight behind a collaborative initiative by the nation’s largest banks to launch a yen‑backed stablecoin. As Japan positions itself at the frontier of payments and digital finance, this marks a critical turning point in how traditional institutions and blockchain converge.

A new era of payments: regulator says yes

The Financial Services Agency (FSA) of Japan has officially endorsed what it calls its “Payment Innovation Project” — a scheme that brings together major banks and corporate players to issue a yen‑denominated stablecoin. According to the announcement, the project begins this month, and the immediate goal is to pilot payment‑stablecoin use among corporate clients.

Participants include Mizuho Bank, MUFG Bank (via its issuance platform “Progmat”), Sumitomo Mitsui Banking Corporation, and Mitsubishi Corporation alongside its financial arm.

The FSA emphasizes that the move responds to a broader trend: the use of blockchain technology to enhance payment systems and corporate settlement frameworks. It also indicated that after the pilot phase, results and conclusions will be published — meaning the regulator wants transparency and oversight from the start.

Why this matters

This development is significant in several key ways.

Firstly, it signals institutional acceptance of stablecoins within a regulated banking environment — not just in cryptocurrencies or niche use‑cases. By backing a yen‑stablecoin initiative, Japan is saying stablecoins deserve a seat at the table of mainstream finance.

Secondly, the collaboration among major banks matters because they serve hundreds of thousands of corporate clients in Japan. The participating banks and firms collectively serve more than 300,000 corporate users. That means this isn’t a small pilot of a handful of users; it has potential scale and could meaningfully impact corporate treasury, cross‑border settlement, and payment efficiency.

Thirdly, for the broader stablecoin and digital‑asset ecosystem, this is a signal that regulatory acceptance paired with traditional banking infrastructure may accelerate adoption. If banks issue — or co‑issue — stablecoins under the oversight of a regulator like the FSA, then the “wild‑west” narrative of crypto may shift toward “bank‑backed digital money” narratives.

Strategic implications for banks and corporates

For the banks involved, launching a stablecoin gives them a dual opportunity: one, to modernize their internal and cross‑corporate settlement operations, and two, to position themselves as platform providers for digital‑asset infrastructure rather than mere intermediaries. For corporates, the promise is lower settlement friction, more real‑time settlement (or closer), and potential cost savings.

However, this is not without challenges. The banks will need to ensure seats at the table for compliance, reporting, reserve transparency (for the coin‑backing), user protection, operational risk (smart‑contract bugs, blockchain outages, etc.), and possibly new regulatory frameworks. The FSA explicitly stressed the need to ensure users are protected and informed.

What the pilot will test and next steps

The pilot phase begins with issuance of payment‑stablecoins by the banks in question. They will likely test transactions among corporate clients, gauge settlement speed, examine cost savings, user experience, and perhaps integration with broader payment rails. Key metrics will probably include transaction volume, error/risk events, compliance overhead, effects on liquidity/reserve management, and customer uptake.

Following completion, the Japanese regulator intends to publish results and conclusions. That transparency will matter widely, as other jurisdictions and digital‑asset players will watch for lessons learned.

Broader regulatory and industry context

This initiative comes amid a broader wave of regulatory openness and crypto‑fintech experiments in Japan. The FSA and other Japanese regulators have recently been active in reviewing regulation for crypto, including considering whether banks can hold crypto, and addressing issues like insider trading in crypto markets.

Japan’s influential role here may serve as a model for other banking systems where stablecoins are considered more than speculative tokens and instead digital representations of fiat‑value for everyday payment and settlement.

Risks and considerations

Even with regulatory backing and major bank involvement, several caveats remain. It’s still early days, so operational glitches could occur — blockchain failures, integration issues with legacy systems, or unanticipated regulatory burdens. The banks will also need to navigate reserves and backing transparency: if the stablecoin is truly backed 1:1 by yen or equivalent assets, reserve audits will be important. They must also address AML/KYC and cross‑border legal issues if the stablecoin is used internationally.

Another consideration is whether corporates will adopt in meaningful volume — changing behavior from existing payment methods (bank transfers, commercial paper, etc.) takes time. And finally, competition could come from non‑bank stablecoins or global stablecoin initiatives, meaning banks must differentiate on trust, integration and regulation.

What to watch

In the coming weeks and months, it will be important to watch for when the banks issue the stablecoin, how many corporates sign up, what volume is processed, how settlement times compare to legacy methods, and whether the project expands beyond domestic corporate clients into cross‑border flows or retail use. Also of interest: how the FSA evaluation is structured and what transparency requirements are imposed.

For the crypto industry more broadly, this could signal an acceleration of tokenized fiat led by regulated banks — possibly raising the bar for stablecoin projects and redefining competition from un‑backed or lightly‑backed tokens toward bank‑backed or regulated stablecoins.

-

Cardano2 months ago

Cardano2 months agoCardano Breaks Ground in India: Trivolve Tech Launches Blockchain Forensic System on Mainnet

-

Cardano2 months ago

Cardano2 months agoCardano Reboots: What the Foundation’s New Roadmap Means for the Blockchain Race

-

Cardano2 days ago

Cardano2 days agoSolana co‑founder publicly backs Cardano — signaling rare cross‑chain respect after 2025 chain‑split recovery

-

Bitcoin2 months ago

Bitcoin2 months agoQuantum Timebomb: Is Bitcoin’s Foundation About to Crack?

-

Cardano2 months ago

Cardano2 months agoAfter the Smoke Clears: Cardano, Vouchers, and the Vindication of Charles Hoskinson

-

Cardano2 months ago

Cardano2 months agoMidnight and Google Cloud Join Forces to Power Privacy‑First Blockchain Infrastructure

-

Ripple2 months ago

Ripple2 months agoRipple CTO David “JoelKatz” Schwartz to Step Down by Year’s End, but Will Remain on Board

-

News2 months ago

News2 months agoRipple’s DeFi Awakening: How mXRP Is Redefining the Role of XRP